montana sales tax rate 2020

While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. Local Tax Rate Combined Rate Rank Max Local Tax Rate.

The Missoula sales tax rate is NA.

. The Montana State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Montana State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Interactive Tax Map Unlimited Use. Senate Bill 159 passed during the 67th Montana Legislative Session reduced the highest marginal tax rate for individuals estates trusts and pass-through entities.

While the base rate applies statewide its only a starting point for calculating sales tax in Montana. The cities and counties in Montana also do not charge sales tax on general purchases so. Sales tax region name.

For an accurate tax rate for each jurisdiction add other applicable local rates on top of the base rate. The states general fund revenues grew modestly in FY 2020 despite the pandemic and is running substantially higher in FY 2021 with forecasts showing. Montana charges no sales tax on purchases made in the state.

There is 0 additional tax districts that applies to some areas geographically within Missoula. This reduction begins with the 2022 tax year. The Montana sales tax rate is currently.

2022 Montana state sales tax. The County sales tax rate is. State State Tax Rate Rank Avg.

Montana currently has seven marginal tax rates. Montana state sales tax rate. Montana has a 0 statewide sales tax rate but also has 73 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0002 on top of the state tax.

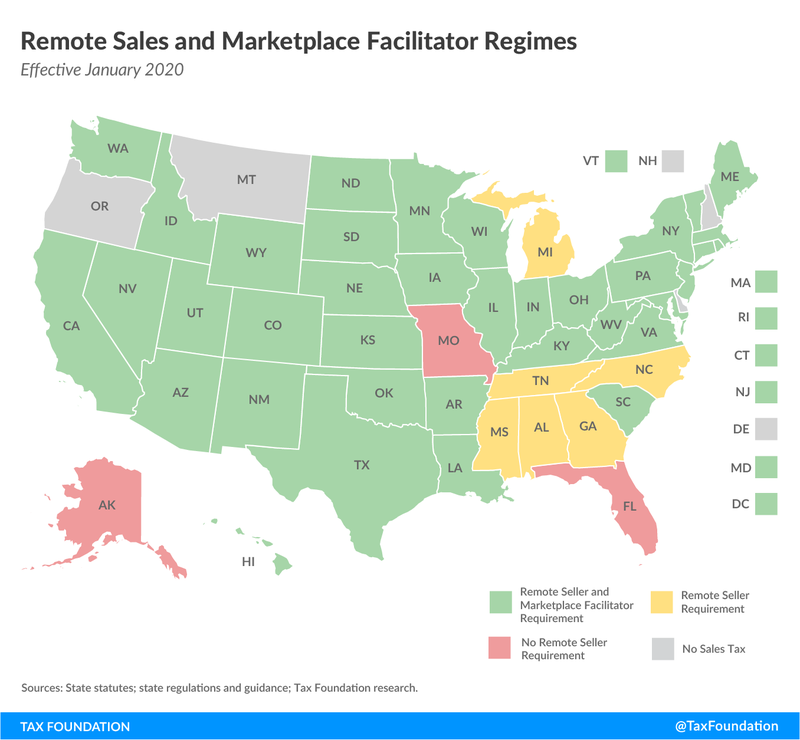

The December 2020 total local sales tax rate was also 0000. The 2018 United States Supreme Court decision in South Dakota v. The recent Montana tax reform package made several changes to individual and corporate taxes.

On the other end of the spectrum is Tennessee whose state sales tax is 955 percent the highest in the US. Tax rates last updated in April 2022. And Friday 900 am.

Exact tax amount may vary for different items. The top tax rate of 69 is the 13th highest in the nation but Montana is one of only six states that allows Federal taxes to be deducted on the state return. State and Local Sales Tax Rates.

The My Revenue portal will no longer be available after July 23 2021. There are additional taxes. Montana has no state sales tax and allows local governments to collect a.

State Business Tax Climate Index. The Bozeman sales tax rate is. The minimum combined 2022 sales tax rate for Bozeman Montana is.

The Montana use tax rate is 0 the same as the regular Montana sales tax. There are additional taxes on tourism-related businesses such as hotels and campgrounds 7. My Revenue is Retiring on July 23 2021.

As of July 1 2020. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. If you have records currently saved in My Revenue we ask you to log into your My Revenue account and download them before July 23 2021.

The current total local sales tax rate in Missoula MT is 0000. Did South Dakota v. The state sales tax rate in Montana is 0 but you can customize this table as needed to reflect your applicable local sales tax rate.

Wayfair Inc affect Montana. State. Montana is one of the five states in the USA that have no state sales tax.

Montana has seven marginal tax brackets ranging from 1 the lowest Montana tax bracket to 69 the highest Montana tax. The lowest state and local sales taxes after Alaskas are in Hawaii 444 percent Wyoming 534 percent Wisconsin 543 percent and Maine 55 percent. Montanas tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Montana local counties cities and special taxation. The Montana Department of Revenue is responsible for publishing the. Montanas income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2004.

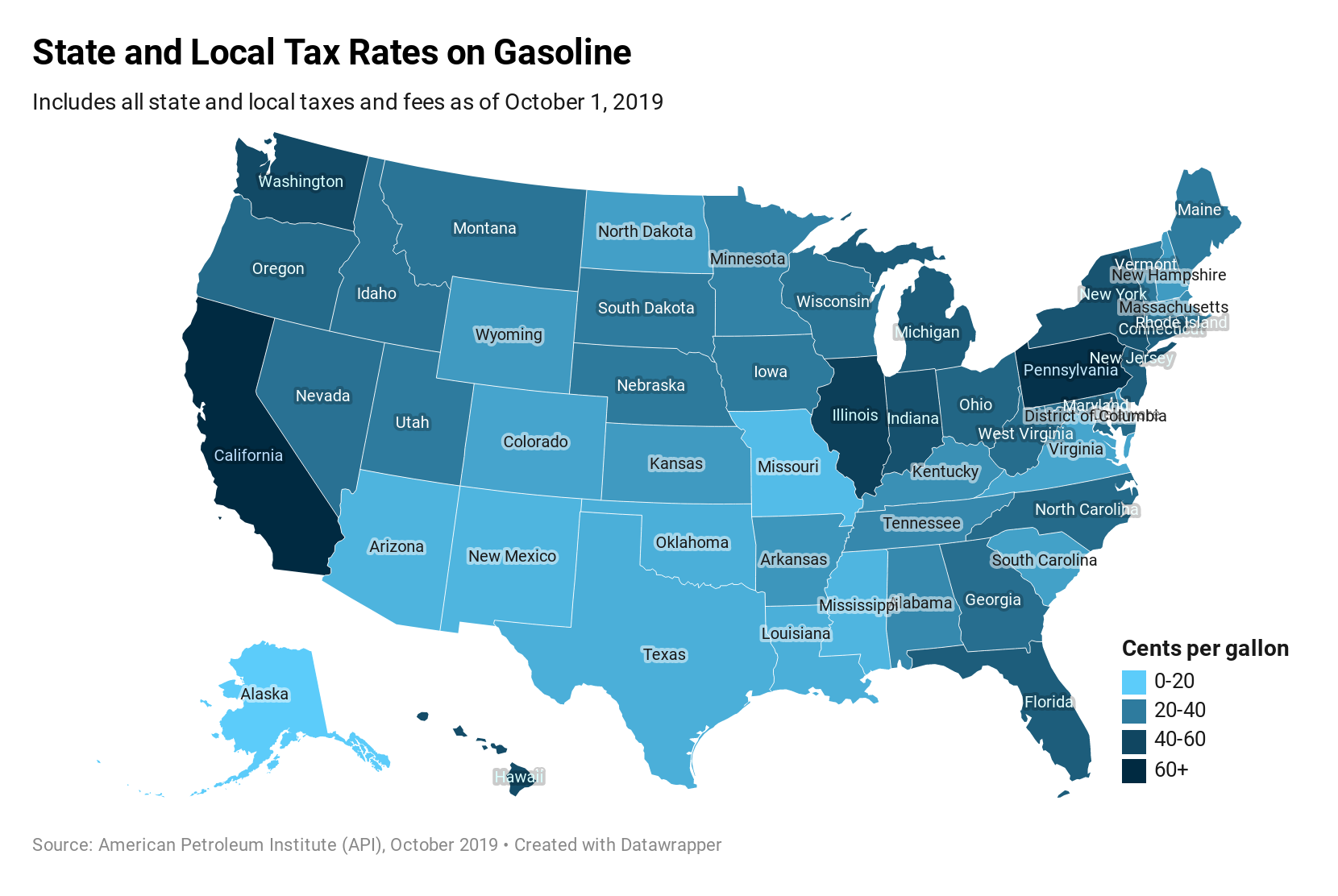

Table 4Top Tax Rates on Ordinary Income California Colorado Idaho Montana Nevada North Dakota Oregon South Dakota Utah Washington. Including local taxes the Montana use tax can be as high as 0000. Get a quick rate range.

While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. The highest tax rate will decrease from 69 to 675 on any taxable income over 19800. If you need help working with the department or figuring out our audit appeals or relief processes the Taxpayer Advocate can help.

Ad Lookup Sales Tax Rates For Free. The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. The December 2020 total local sales tax rate was also 0000.

The state sales tax rate in Montana is 0000. Consumer Counsel Fee CCT Consumer Counsel Fee CCT Contractors 1 Gross Receipts Tax CGR Contractors 1 Gross Receipts Tax CGR Emergency Telephone System Fee. Base state sales tax rate 0.

There are no local taxes beyond the state rate. All Businesses Cannabis Control Individuals Licenses Property Tobacco and Nicotine. This is the total of state county and city sales tax rates.

Montana has a modestly progressive personal income tax. The Montana use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Montana from a state with a lower sales tax rate. Were available Monday through Thursday 900 am.

Department of Revenue forms will be made available on MTRevenuegov.

Sales Tax By State Is Saas Taxable Taxjar

How Do State And Local Sales Taxes Work Tax Policy Center

How Is Tax Liability Calculated Common Tax Questions Answered

Software Sales Tax Use Tax Avalara

States Without Sales Tax Article

How High Are Cell Phone Taxes In Your State Tax Foundation

U S States With No Sales Tax Taxjar

Montana Tax Information Bozeman Real Estate Report

How Is Tax Liability Calculated Common Tax Questions Answered

State Corporate Income Tax Rates And Brackets Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

U S Sales Taxes By State 2020 U S Tax Vatglobal

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

A Visual History Of Sales Tax Collection At Amazon Com Itep

States With Highest And Lowest Sales Tax Rates

A Small Business Guide To E Commerce Sales Tax The Blueprint